Working with Sales Tax

Use the instruction below as a guide to viewing and adjusting tax information for an order.

Key Terms

- Tax Code - a specific rate charged for a specific entity, such as a city, township, county, state or country. Tax codes are defined in the Environment module: Accounts Receivable > Sales Tax Code.

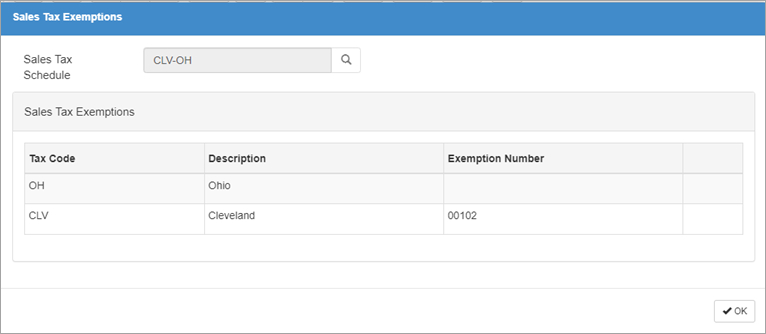

- Sales Tax Schedule - a collection of one or more tax codes that determine a total taxable amount. Example: If material provided to a job in Cleveland Ohio is subject to Ohio state tax and Cleveland city tax, you could create a tax schedule CLV-OH that includes the tax codes for Ohio and Cleveland. Tax schedules are defined in the Environment module: Accounts Receivable > Sales Tax Schedule.

- Tax Class - Indicates whether a product or product class is Taxable and Non-Taxable.

- Exemption - indicates that an order, product, or product class is exempt (non-taxable) for a particular tax code. Entering a value in Exemption automatically sets the corresponding tax amount to 0.

Setting the Tax Schedule and Exemptions

To set the order's tax schedule:

- On the Left Menu > Shipping/Billing page, select the Tax Schedule that applies to the order.

To add exemptions for specific tax codes:

- On the Left Menu > Shipping/Billing page, click Sales Tax Exemptions.

The Exemptions window displays.

- Enter an Exemption Number for the appropriate tax class(es).

- Click OK.

Changing Tax Class

To change the tax class for a line item:

- On the Line Entry page, in the grid, click on the desired line item.

- In the Right Panel, select Pricing/Billing.

- Change the Tax Class field.

To change the tax class for a sales order summary line:

- On the Sales Order Summary page, in the grid, click on the desired product or product class row.

- In the Right Panel, select Cost/Profit Estimate.

- Change the Tax Class field.

Viewing Tax Details

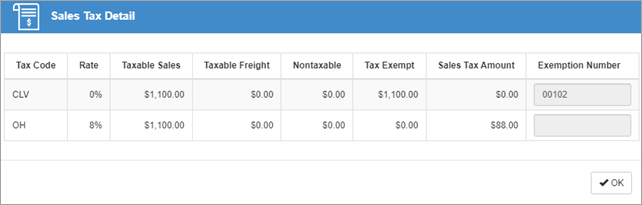

To view tax details for a sales order summary line:

- On the Sales Order Summary page, in the grid, click on the desired product or product class row.

- In the Right Panel, select Cost/Profit Estimate.

- Click the Tax Details> Details button.

The Sales Tax Detail window displays. This window is view only.

- Click OK.

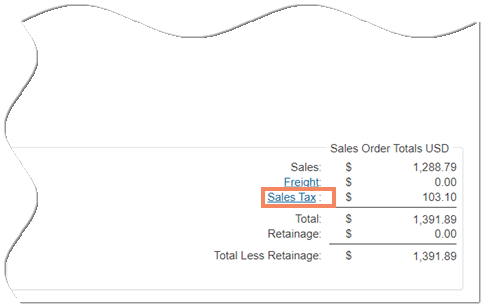

To view sales tax details for the entire order:

- On the Sales Order Summary page, click Sales Tax.

The Sales Tax Detail window displays. This window is view only.